I'm writing this article on a computer made from components that were built in a dozen different factories. In turn, these components were made from materials from all over the world. The plastics were likely made from Middle Eastern oil, copper probably came from Chile, silicon from China, lithium from Australia, chromium from South Africa, nickel from the Philippines, etc...

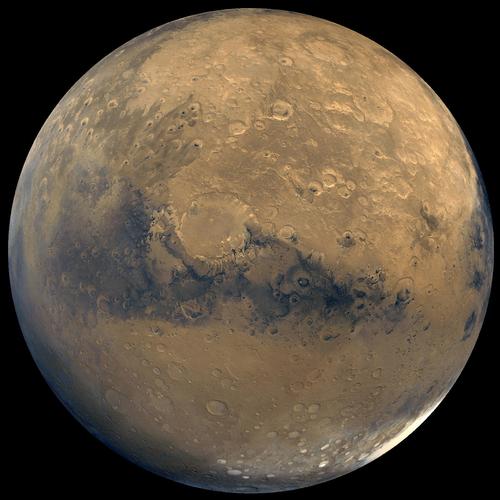

Currently, the modern world is built on a complex web of global trade that relies on tens of millions of people. Simply reproducing basic pieces of critical technology on a new planet would take numerous mines, refineries, and factories spread all over. Each of these factories would need to be staffed and would require local communities to provide them with basic services.

The minimum number of people a new planet would need to be capable of building computers, tractors, phones, antibiotics, and other basic necessities of modern life could easily be in the millions or tens of millions.

This creates a serious problem for any possible colony, on a new planet either in this solar system or a nearby one, with relatively few solutions:

- Send a truly massive number of colonists at once.

- Pay the expense of constantly providing a colony with new technological supplies for decades.

- Have colonists willing to lose access to modern technology for possibly generations until the population grows to a minimum level. (Not really viable on a planet without a breathable atmosphere.)

- Find a way to make necessary equipment extremely durable while the population grows.

- Come up with a way to make advanced technologies on a small scale using few elements, like super advanced 3D printing.